Recently, media outlets reported that Bitcoin and Ethereum prices continued their decline amid a decline in overall risk sentiment, wiping out over $140 billion in total cryptocurrency market capitalization in a single week. Meanwhile, the impending expiration of $22 billion in options casts a new shadow over the market outlook.

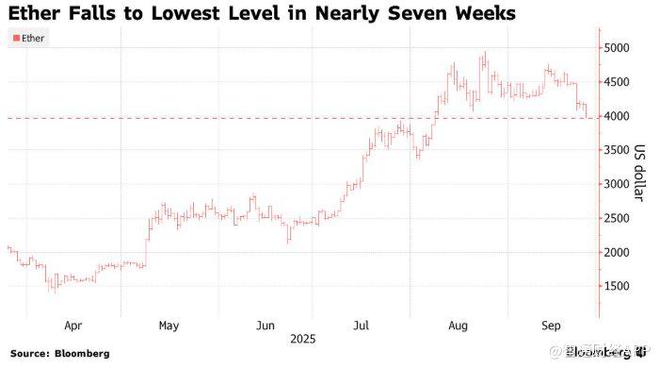

Ethereum briefly fell 8.2%, falling below $4,000, its lowest level in nearly seven weeks. Bitcoin fell below $110,000 for the first time in four weeks, a drop of approximately 3.3%. More speculative tokens such as Dogecoin and Cronos experienced even greater declines, plummeting 9.4% and 10%, respectively.

Ethereum prices fell to their lowest level in nearly seven weeks.

Lex Sokolin of Generative Ventures, a venture capital firm, said: "We are witnessing a de-risking trend across the market. Memecoins, or assets without solid fundamentals, are being hit first and tend to be more reactive in both rallies and rallies. Many positive catalysts, such as regulation, digital asset treasuries (DATs), and interest rate cuts, are already priced in, so the market needs a new narrative to maintain upward momentum."

The next test will come on Friday, September 26th, when over $17 billion in open interest in Bitcoin and approximately $5.3 billion in open interest in Ethereum expire, according to data from derivatives exchange Deribit.

This week's pullback began with the liquidation of $1.7 billion in long positions, another reminder to investors that liquidations on opaque offshore exchanges are common in the cryptocurrency market. Forced liquidations can lead to significant market fluctuations across different trading venues due to uneven disclosure and varying index rules. According to data compiled by Coinglass, approximately $1 billion in positions were liquidated on Thursday, September 25th.

BTC Markets cryptocurrency analyst Rachael Lucas said Ethereum's decline is due to "slowing institutional inflows" and "technical signals suggest short-term pressure." She expects further liquidation if Ethereum falls below $3,800.

Since Monday, September 22, investors have withdrawn nearly $300 million from U.S.-listed Ethereum exchange-traded funds.

Further declines could put pressure on publicly traded companies that hold billions of dollars in Ethereum or Bitcoin on their balance sheets. These companies' market capitalizations are closely tied to cryptocurrency prices.

Market volatility has also affected confidence in cryptocurrency finance companies. Net asset value premiums are shrinking, newly issued shares are diluting existing shareholders, and many stocks are trading close to the value of their holdings.

Shares of two digital asset management companies, Bitmine Immersion Technologies (BMNR.US) and SharpLink Gaming (SBET.US), fell by more than 8% at one point on Thursday.

Even with this week's volatility, Bitcoin and Ethereum remain among the best-performing major assets this year.

“If we see Ethereum close below $4,000, the next stop would be between $3,700 and $3,500,” said Tony Sycamore, an analyst at IG Australia.

%20--%3e%3c!DOCTYPE%20svg%20PUBLIC%20'-//W3C//DTD%20SVG%201.1//EN'%20'http://www.w3.org/Graphics/SVG/1.1/DTD/svg11.dtd'%3e%3csvg%20version='1.1'%20id='图层_1'%20xmlns='http://www.w3.org/2000/svg'%20xmlns:xlink='http://www.w3.org/1999/xlink'%20x='0px'%20y='0px'%20width='256px'%20height='256px'%20viewBox='0%200%20256%20256'%20enable-background='new%200%200%20256%20256'%20xml:space='preserve'%3e%3cpath%20fill='%23FFFFFF'%20d='M194.597,24.009h35.292l-77.094,88.082l90.697,119.881h-71.021l-55.607-72.668L53.229,232.01H17.92%20l82.469-94.227L13.349,24.009h72.813l50.286,66.45l58.148-66.469V24.009z%20M182.217,210.889h19.566L75.538,44.014H54.583%20L182.217,210.889z'/%3e%3c/svg%3e)