Deutsche Bank's latest research indicates that major central banks are likely to significantly increase their holdings of Bitcoin and gold assets by 2030, driven by growing institutional acceptance and a weakening US dollar. In a recent report, Deutsche Bank's London-based senior economist Marianne Laubre and analyst Camilla Siasson emphasized that for central banks, Bitcoin allocations could become a new "foundation of financial security," with a strategic role comparable to that of gold in the 20th century.

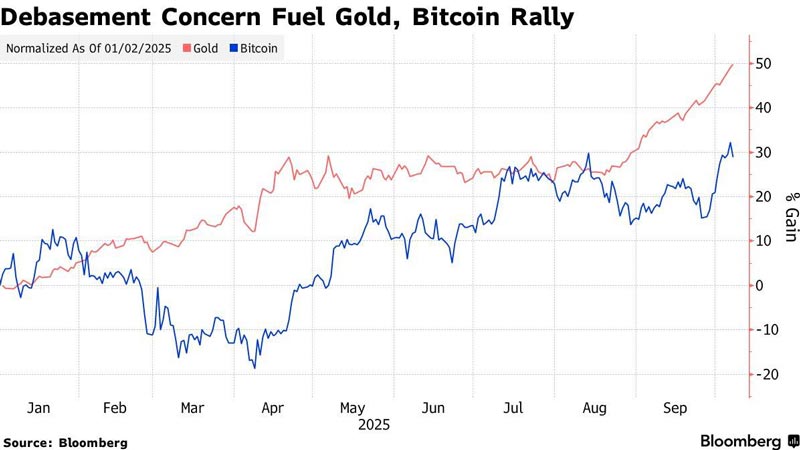

This prediction comes as global demand for both Bitcoin and gold is reaching record highs. Economic uncertainty and geopolitical risks caused by US tariffs are prompting investors to accelerate hedging against inflation risks and prepare for the evolution of the traditional fiat monetary system.

Gold, a traditional safe-haven asset, has now broken through the $4,000 per ounce mark. While Bitcoin is trading slightly below its historical peak this week, its role as an institutional safe-haven is becoming increasingly prominent. Research shows that gold's share of central bank balance sheets has increased significantly since the 2008 financial crisis.

It was this flight to safety among institutional investors that forced central banks to become net buyers of gold starting in 2010. Now, trade uncertainty and increased market volatility have further fueled gold's renewed favor—global central bank gold reserves have exceeded 36,000 tons, confirming a "gold comeback."

Deutsche Bank analysis indicates that the rise in gold prices is closely linked to the de-dollarization process. Data shows that the dollar's share of global reserves has fallen from 60% in 2000 to 41% in 2025, a trend that benefits both gold and Bitcoin. In June of this year, gold and Bitcoin ETFs saw net inflows of $5 billion and $4.7 billion, respectively, both setting monthly records.

Laubre specifically noted that the 20th-century market's embrace of gold offers a stark contrast to the current debate among policymakers surrounding Bitcoin—although Bitcoin's role as a reserve asset remains controversial, its popularity and market performance have reached record highs.

However, this view is not without its critics. A recent report by JPMorgan analysts suggests that stablecoins could generate new demand for the US dollar, potentially leading to an expansion of the stablecoin market and potentially generating an additional $1.4 trillion in US dollar demand by 2027. This casts a shadow on Deutsche Bank's gold-and-Bitcoin reserve strategy.

In response, Laubre stated that neither Bitcoin nor gold can fully replace the US dollar. Within the central bank's reserve framework, digital assets should serve as a "complement" to, rather than a substitute for, sovereign currencies. She further noted that market confidence is growing as volatility gradually subsides and regulatory support from the US, China, and other countries increases.

%20--%3e%3c!DOCTYPE%20svg%20PUBLIC%20'-//W3C//DTD%20SVG%201.1//EN'%20'http://www.w3.org/Graphics/SVG/1.1/DTD/svg11.dtd'%3e%3csvg%20version='1.1'%20id='图层_1'%20xmlns='http://www.w3.org/2000/svg'%20xmlns:xlink='http://www.w3.org/1999/xlink'%20x='0px'%20y='0px'%20width='256px'%20height='256px'%20viewBox='0%200%20256%20256'%20enable-background='new%200%200%20256%20256'%20xml:space='preserve'%3e%3cpath%20fill='%23FFFFFF'%20d='M194.597,24.009h35.292l-77.094,88.082l90.697,119.881h-71.021l-55.607-72.668L53.229,232.01H17.92%20l82.469-94.227L13.349,24.009h72.813l50.286,66.45l58.148-66.469V24.009z%20M182.217,210.889h19.566L75.538,44.014H54.583%20L182.217,210.889z'/%3e%3c/svg%3e)