On October 6th, AMD's stock price soared over 37% in pre-market trading. According to the latest news, AMD and OpenAI have reached a four-year agreement to provide OpenAI with hundreds of thousands of AI chips and grant OpenAI an option to acquire up to 10% of the company's shares.

The deal is expected to generate tens of billions of dollars in revenue for AMD and may mark AMD's most aggressive challenge yet to industry leader Nvidia in the lucrative AI accelerator market.

Notably, shortly before OpenAI announced its investment in AMD, Nvidia announced an investment of up to $100 billion in OpenAI.

On September 22nd, Pacific Time, Nvidia announced on its official website a "landmark AI infrastructure partnership" with OpenAI, which will expand OpenAI's computing power through multi-gigawatt (GW) data centers powered by millions of Nvidia GPUs. Nvidia also plans to gradually invest up to $100 billion in OpenAI, with the specific amount to be allocated based on the progress of each gigawatt of deployment.

"No partner other than Nvidia can do this at this scale and at this speed," OpenAI co-founder and CEO Sam Altman said at the time.

AMD Issues Warrants to OpenAI

Stock Price Soars

On October 6th, OpenAI announced on its website a partnership with AMD to deploy a total of 6 gigawatts (GW) of AMD GPU computing power.

The press release stated that the infrastructure being collaborated between the two companies will be powered by multiple generations of AMD Instinct GPUs, with the initial 1 GW deployment of AMD Instinct MI450 GPUs scheduled to begin in the second half of 2026.

As part of the collaboration, AMD issued warrants to OpenAI for up to 160 million shares of AMD common stock. The first tranche of warrants will be unlocked when OpenAI completes its first 1 GW deployment; additional warrants will be unlocked as the deployment scales to 6 GW.

Furthermore, the vesting conditions of the warrants are tied to AMD's stock price target and OpenAI's achievement of technical and commercial milestones. If OpenAI exercises all of its warrants, it will acquire approximately a 10% stake in AMD.

Analysts point out that the new agreement represents another major data center deal for OpenAI to expand its computing power, reflecting an unprecedented bet in the tech industry and the continued rapid growth in demand for energy-intensive artificial intelligence (AI) tools.

AMD stated that the collaboration with OpenAI will generate significant revenue starting next year and accelerating further by 2027. Furthermore, the partnership will serve as a springboard for the broader application of the company's technology, potentially driving AI revenue to over $100 billion.

AMD CEO Lisa Su said in a statement, "This collaboration brings together the strengths of our two companies, creating a truly mutually beneficial partnership that will power the world's most ambitious AI infrastructure and advance the entire AI ecosystem."

For OpenAI, the partnership with AMD could help it build an alternative to Nvidia's monopoly. Currently, a significant portion of OpenAI's budget is spent on Nvidia technology, and the company is in talks with Broadcom regarding custom chips.

Altman stated, "This collaboration is an important step in building the computing power needed to realize the full potential of AI. AMD's leadership in high-performance chips will enable us to accelerate our progress and bring the benefits of advanced AI to everyone more quickly."

As of press time, AMD's stock price was trading at $210.47, up 27.81%, with a market capitalization of approximately $341.6 billion.

However, the agreement with OpenAI also brings AMD into the increasingly heated debate in the tech industry: how to recoup massive AI infrastructure spending and whether the current pace of expansion is sustainable.

Some analysts worry that if any link in the chain begins to weaken, the internal cycle between the companies could come under real pressure.

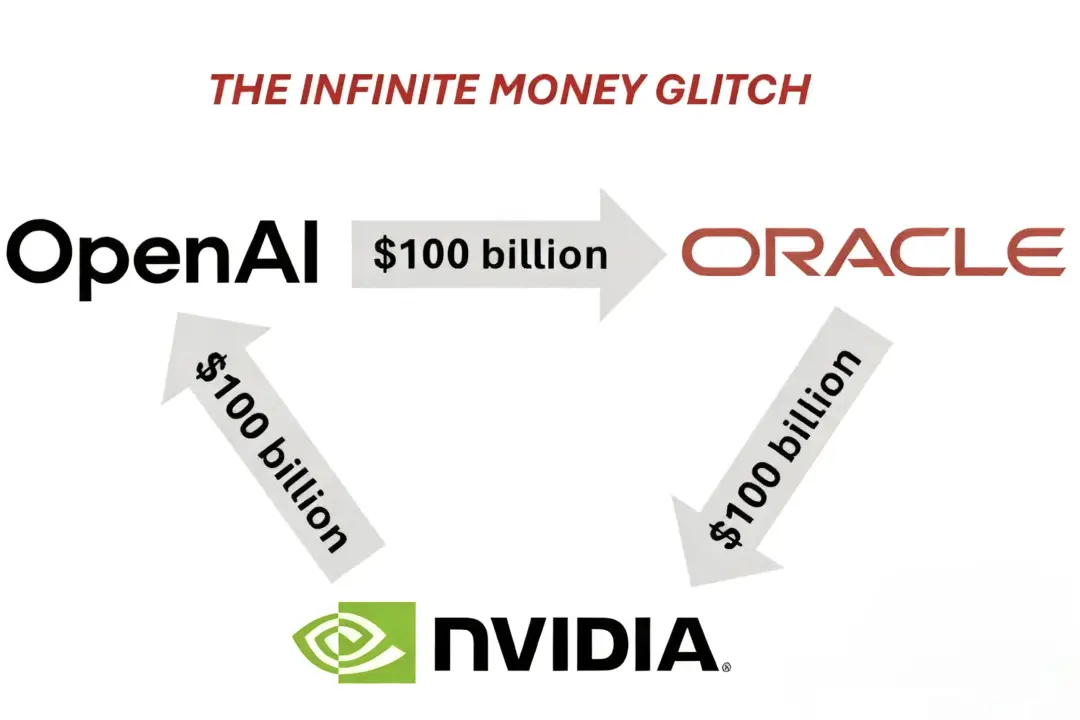

For example, through massive investments and strategic partnerships, the three AI giants "ONO" (OpenAI, Nvidia, and Oracle) appear to have formed a tight "triangle" to build the next generation of AI computing power. The diagram below clearly illustrates this closed loop formed by the triad of "large models, cloud infrastructure, and computing chips."

However, OpenAI, a giant in AI applications valued at $500 billion, is far from profitable. Instead, it is suffering losses. According to a previous report by The Information, based on undisclosed internal financial data and analysis by industry experts, OpenAI projects losses exceeding $5 billion in 2025. In June of this year, OpenAI disclosed annual revenue of approximately $10 billion, less than one-fifth of its $60 billion annual expenditure on building data centers and leasing computing power from Oracle.

OpenAI and Nvidia Seek to Expand into the Japanese and Korean Markets

According to a report by Reference News, citing the Nikkei website on October 3rd, senior executives from the US Open AI Research Center (OpenAI) and other technology companies, including Nvidia, have recently visited Japan frequently. As the vanguard of the US government's efforts to compete for technological supremacy by exporting artificial intelligence (AI) technology and infrastructure, they are seeking to expand into the Japanese and Korean markets.

OpenAI CEO Sam Altman visited Hitachi, Ltd. and other organizations in Tokyo on the 2nd. This was his first public visit to Japan since February of this year. Previously, he has actively established connections with politicians, universities, and businesses around the world through so-called "Altman diplomacy" to expand his business reach.

Altman is working to further upgrade his conversational AI program, ChatGPT, and to build hyperscale data centers in the United States to support AI operations and develop related terminal equipment. He hopes the visit will garner corporate support for his plans and raise funds for the massive investment required. Furthermore, he will promote American AI technology through high-level exchanges.

OpenAI has reached a preliminary strategic partnership agreement with Hitachi and has secured Hitachi's support for the "Stargate" project, which aims to build AI data centers and other infrastructure in the United States and other locations. During a previous visit to South Korea, Altman reached agreements with Samsung Electronics and SK Hynix for the purchase of memory semiconductors.

In January of this year, US President Trump announced a joint investment initiative called "Stargate," with OpenAI, SoftBank, and Oracle as primary investors. The Stargate project plans to invest $100 billion in building AI computing servers, with this investment expected to increase to $500 billion over four years.

According to reports, the Trump administration, in its first comprehensive AI plan, proposed a strategy to relax regulations on AI development and expand exports of advanced AI models, semiconductors, and cloud technology. This strategy aims to counter China's rapidly catching up in development capabilities by promoting American technology globally. Tech companies that have swiftly responded to the Trump administration's policies are increasingly playing the role of faithfully implementing this national strategy.

Nvidia CEO Jensen Huang visited the Japanese Prime Minister's official residence in April, and Apple CEO Tim Cook also visited Japan in late September. Both visits emphasized deepening partnerships with Japanese companies and were heavily lobbying efforts aimed at establishing communication channels with the government.

For the Japanese government and businesses, establishing relationships with companies like OpenAI and Nvidia certainly helps them access cutting-edge technology. However, the widespread adoption of these tech giants' products and services would also deepen their dependence on American technology, further widening the "digital deficit" in their balance of payments.

OpenAI's major event is coming soon.

OpenAI's Developer Day event, scheduled for October 6th, is also attracting significant market attention.

The market generally expects the company to release new consumer-grade AI agent products and possibly an AI browser to challenge Google Chrome. These potential releases would mark a significant shift for OpenAI from relying on a subscription model for ChatGPT to a diversified product portfolio.

According to the Wind Trading Desk, UBS stated in a recent research report that OpenAI is seeking to significantly grow its current $13 billion in revenue, aiming for a $200 billion revenue target by 2030. To achieve this goal, the company must develop new growth engines beyond its core ChatGPT business.

According to the UBS report, ChatGPT's user growth trajectory is impressive, with weekly active users increasing by 250% year-over-year from 200 million in the same period last year to 700 million currently. This growth rate is nearly identical to OpenAI's total revenue growth rate, confirming ChatGPT's position as a key growth engine. Based on current trends, ChatGPT is expected to surpass the 1 billion user mark by the end of the year.

Through multiple industry surveys, the bank's analysts predict that the OpenAI Developer Day to be held on October 6 will mainly focus on the release of consumer-grade AI products. In addition to the already launched instant checkout function and personalized AI agent ChatGPT Pulse, travel booking agent is considered to be one of the key directions.

%20--%3e%3c!DOCTYPE%20svg%20PUBLIC%20'-//W3C//DTD%20SVG%201.1//EN'%20'http://www.w3.org/Graphics/SVG/1.1/DTD/svg11.dtd'%3e%3csvg%20version='1.1'%20id='图层_1'%20xmlns='http://www.w3.org/2000/svg'%20xmlns:xlink='http://www.w3.org/1999/xlink'%20x='0px'%20y='0px'%20width='256px'%20height='256px'%20viewBox='0%200%20256%20256'%20enable-background='new%200%200%20256%20256'%20xml:space='preserve'%3e%3cpath%20fill='%23FFFFFF'%20d='M194.597,24.009h35.292l-77.094,88.082l90.697,119.881h-71.021l-55.607-72.668L53.229,232.01H17.92%20l82.469-94.227L13.349,24.009h72.813l50.286,66.45l58.148-66.469V24.009z%20M182.217,210.889h19.566L75.538,44.014H54.583%20L182.217,210.889z'/%3e%3c/svg%3e)