On September 5th, US Eastern Time, an executive order was signed stating that starting at midnight on September 8th, US Eastern Time, gold and a host of other key products will be exempt from tariffs. Let me tell you, these policies change faster than turning the pages of a book. Didn't they just say a while ago that they would impose a 39% tariff on Swiss gold?

At the time, I complained to a friend, saying that if this were to happen, international gold prices would be thrown into chaos. But a few days later, he changed his tune on social media, saying that gold would no longer be taxed. Isn't that strange?

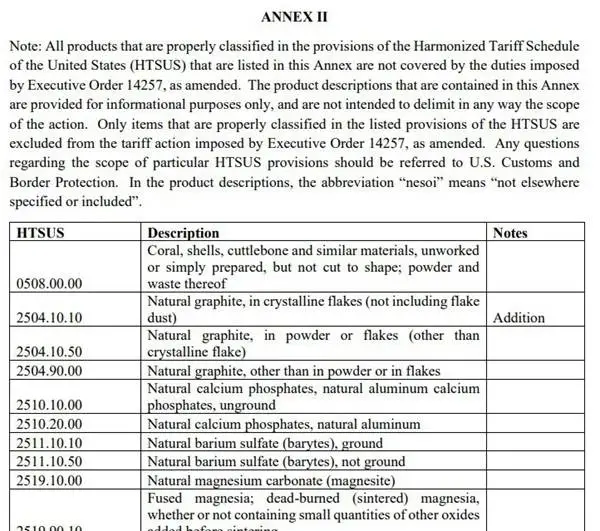

In addition to gold, the exemption list also includes tungsten, uranium, and other metals that sound very "high-tech," supposedly used in high-tech industries and defense.

Even more interestingly, generic drugs, coffee, and even specialty spices are exempted. So, coffee can't even be grown in the US? Come to think of it, they primarily grow corn and soybeans there, so coffee does have to be imported.

Image source: White House

But then again, I don't quite understand the logic behind grouping gold and coffee together for tariff exemptions. Perhaps this is what's known as "critical products"?

By the way, there's another hilarious detail here. The order signed this time states that going forward, the Office of the US Trade Representative and the Department of Commerce will be able to directly handle tariff reductions, eliminating the need for Trump to sign them individually. When I saw this, I wondered: Is this just a hassle? Or is it a desire to delegate power so someone can take the blame if policies go awry? After all, a federal appeals court recently ruled that his previous general tariffs were illegal, stating that the power to levy taxes belongs to Congress, and the president can't arbitrarily impose them using emergency laws. Could this change be an attempt to avoid legal risks?

But honestly, the companies most excited about this policy are probably those in the high-tech industry. Companies like those in aerospace and medical equipment use rare metals that previously faced significant taxes, but now they're exempt, significantly reducing costs. On the other hand, silicon products have been added to the tariff list. A friend of mine in the semiconductor business complained to me yesterday, saying that chip costs are already high, and now with the added tariffs, product pricing will become a problem. You see, with this policy of exemptions and increases, how can businesses handle it?

There's another thing I'm not quite understanding. If they're exempting key products to reduce costs, why is the US manufacturing PMI still hovering below the boom-bust line? It was only 48.7 in August, and has been below 50 for six consecutive months. Didn't Ford Motor Company say that tariffs alone will cost them $2 billion in profits this year? And that's even with some product exemptions. Logically, with so many products exempted, costs should have fallen, so why hasn't the manufacturing industry seen any improvement? Is it because the exemptions aren't strong enough, or is there something else going on?

Oh, and I forgot to mention that many of the products exempted this time are "unable to be produced domestically or in insufficient quantities in the United States." That's a fair point, but on the other hand, doesn't this also indicate that American industries have shortcomings? If even basic raw materials have to be imported, then the so-called "re-shoring of manufacturing" becomes empty talk. For example, tungsten and uranium cannot be mined domestically in the US and can only be imported from other countries. The current tariff exemptions are, in fact, a necessary measure.

However, I'm a little skeptical about how long this policy will last. After all, the Supreme Court hasn't yet made a final ruling on the illegality of the previous tariffs. If the Supreme Court also rules against this exemption, wouldn't these companies' excitement be in vain? And for importers with long-term contracts, will they be subject to the new or old policies? If they need to refund the tariffs later, the process would be incredibly tedious.

I remember hearing people say that US policymaking requires layers of deliberation. Why has Trump's tariffs been like playing house these past few years, sometimes adding, sometimes waiving. Take gold, for example. On August 7th, he announced tariffs on Swiss products, only to exempt them a few days later. And that's only a few days apart. Everyone in the market is probably in a state of panic. Those who want to buy are afraid to buy, and those who want to sell are afraid to sell.

But to be honest, this exemption for gold does help stabilize the market. I heard a while ago that the international gold futures market was in turmoil due to the proposed tariff increase. Now that it's exempted, it should at least stabilize expectations. But then again, if the policy changes again in the future, won't the market fluctuate again?

Now that I think about it, this tariff policy is like the weather—it changes at a moment's notice. If companies just follow the policy, expanding production one day and reducing it the next, they'll eventually collapse. I think instead of making such frequent adjustments, they should carefully plan which industries truly need support and which products truly need to be imported, and formulate a long-term, stable policy. Otherwise, if this volatility continues, not only will businesses suffer, but even ordinary consumers will have to pay higher prices.

Is Trump doing this to boost the economy or to win votes for the upcoming election? If it's to win votes, will these exempted products truly benefit ordinary people? For example, if generic drugs are exempted, how much can drug prices be reduced? Will ordinary people actually feel the impact?

No matter how policies change, the ultimate outcome depends on actual results. If manufacturing doesn't take off and people's cost of living doesn't fall, then any further tariff adjustments will be useless.

%20--%3e%3c!DOCTYPE%20svg%20PUBLIC%20'-//W3C//DTD%20SVG%201.1//EN'%20'http://www.w3.org/Graphics/SVG/1.1/DTD/svg11.dtd'%3e%3csvg%20version='1.1'%20id='图层_1'%20xmlns='http://www.w3.org/2000/svg'%20xmlns:xlink='http://www.w3.org/1999/xlink'%20x='0px'%20y='0px'%20width='256px'%20height='256px'%20viewBox='0%200%20256%20256'%20enable-background='new%200%200%20256%20256'%20xml:space='preserve'%3e%3cpath%20fill='%23FFFFFF'%20d='M194.597,24.009h35.292l-77.094,88.082l90.697,119.881h-71.021l-55.607-72.668L53.229,232.01H17.92%20l82.469-94.227L13.349,24.009h72.813l50.286,66.45l58.148-66.469V24.009z%20M182.217,210.889h19.566L75.538,44.014H54.583%20L182.217,210.889z'/%3e%3c/svg%3e)